International oil and gas companies are presented with so many exploration opportunities that they cannot all be actively pursued. In order to decide where to commit resources the exploration opportunities need to be analysed and ranked (preferably as quickly as possible), based upon the quality of each opportunity and the risks (geologic, engineering and economic) associated with it.

This blog outlines some simple ways to improve your understanding of the geologic risk associated with your oil and gas opportunities, be they plays, licenses, prospects or producing fields.

Resource Appraisal in Oil Exploration

It has been well documented (see below) that by better understanding the risks associated with each of their plays petroleum companies can reduce technical uncertainty in their exploration efforts:

- Resource Appraisal Methods: Choice and Outcome – Miller, AAPG, 1986

- Geologic Risking Guide for Prospects and Plays – White, AAPG, 1993

- Play Fairway Analysis using GIS based Common Risk Segment Mapping – Cooper, CSPG, 2006

- Use of Geographic Information Systems in Hydrocarbon Resource Assessment and Opportunity Analysis – Hood, AAPG Computer Applications in Geology, No. 4, 2000

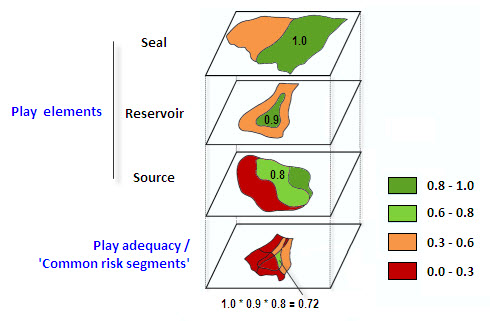

As part of this, play fairway and opportunity risking analysis (including Common Risk Segment mapping) have been identified as key. These methods reduce overall exploration risk because oil and gas companies are (generally) less likely to bid for high risk acreage, or to work-up or drill prospects in high risk plays.

Barriers to Analysis

Traditionally block and opportunity ranking workflows have been incredibly complex, due to a number of factors, e.g.:

- Data required to do the analysis often resided in multiple systems and required great effort to be integrated together.

- Heterogeneous data formats between such systems meant data translation, which was time consuming and also introduced errors.

- Due to the complexities data simplification was often required just to perform the analysis, which kind of defeated the object of the exercise.

- The analysis could often only answer a narrow set of questions, and was not designed to be scalable or integrated.

Often these barriers proved insurmountable, and many oil and gas companies have had to live without performing these types of analysis, especially within the pressure-cooker environment of a licensing or bidding round.

In addition, and as exemplified by the story of the exploration manager who told his staff words to the effect of “I’ll tell you where we explore for oil, not some bit of software!”, there are human elements at play here, e.g.

- As Clare Bond and others have shown, geoscientists introduce their own interpretation bias based on their past experiences.

- You can’t know what you don’t know, regardless of how clever you think you are.

Data Driven Analysis

Exploration Analyst software helps you rapidly build common risk segment maps for play fairway mapping. Outputs from Exploration Analyst can be used as an input to the acreage ranking in order to summarise play potential across the area, allowing explorationists to rank each lease based on a measure of prospectivity, as well as by any other factors (e.g. distance to infrastructure, environment sensivities, etc.). Again, the use of a computer-driven quantitative approach allows the user to rapidly repeat the analysis, and to analyse sensitivities. The software also enables you to summarise oil opportunities (e.g. leases, blocks, fields, etc.) based on the spatial relationship between each opportunity (e.g. oil lease, field, etc.) and multiple input data sets. The key to the tool is that it uses quantitative analysis, although the geoscientist can apply their own scoring schema and weightings to the analysis results.

It goes without saying that for either tool the input datasets must be valid and accurate, in the same way that a geophysicist’s seismic interpretation is dependent on having the best quality seismic data available. And clearly the quality of the analysis is wholly dependent on the interpretation of the geoscientist operating the tools.

Significant Productivity Gains and Improved Decisions

Both tools described above allow oil and gas companies to start doing what the Cooper, Miller, White and Hood papers describe, without having to develop bespoke in-house tools.

The bottom line is that the tools provide oil and gas companies with significant productivity gains when performing important exploration analysis (i.e. creating common risk segment maps and performing acreage/opportunity screening). The benefits of this are:

- The streamlined computer driven process is much easier than traditional manual methods, meaning that the analysis actually gets done in the first place.

- The speed of the analysis means it can be run multiple times within a given work-cycle, allowing you to evaluate sensitivities and try out different theories and scenarios. This can dramatically improve your decision quality.

This in turn has the effect of significantly improving the geotechnical interpretation and this leads to a greater understanding of what’s actually going on. This reduction in technical uncertainty significantly reduces your G&G risk.

Posted by Chris Jepps, Technical Director, Exprodat.